For years now, Bitcoin and other cryptocurrencies have been a hot topic in finance. But they’ve recently hit the headlines within the real estate industry.

The first property to be bought with Bitcoin in the UK was back in 2017. A trickle of transactions took place afterwards in pioneering markets like Dubai. However, since the COVID crisis, Crypto-commoditised property transactions have begun increasing sharply, on a global scale.

Job redundancies triggered by the pandemic, saw many people turn to crypto trading as a source of income. Now we’re seeing these investors shift their profits into one of the world’s safest assets; real estate.

The escalating value of cryptocurrencies has also created a greater willingness by property vendors to accept Bitcoin and its ilk as a form of transaction currency. This in turn has unlocked the opportunity for crypto-investors to crystallise their profits, trading out of the volatile asset class, and into stable property assets.

Young Guns

It’s not just sophisticated traders that’ve got in on the action. Real Estate Agents have reported rapid recent growth in young property buyers. Those early adopters who, marginalised by the global economic shocks of recent years, have profited from coin trading, are now diversifying their holdings.

This group of young crypto-slinging millionaires are emerging as a new wealthy class, breaking the conventional real estate order.

The allure of this new swathe of property buyers has in turn attracted a new breed of seller. Those who want to keep their options open and get in on the action, are increasingly using the “Accepting bitcoin” USP, and broadening their investment appeal.

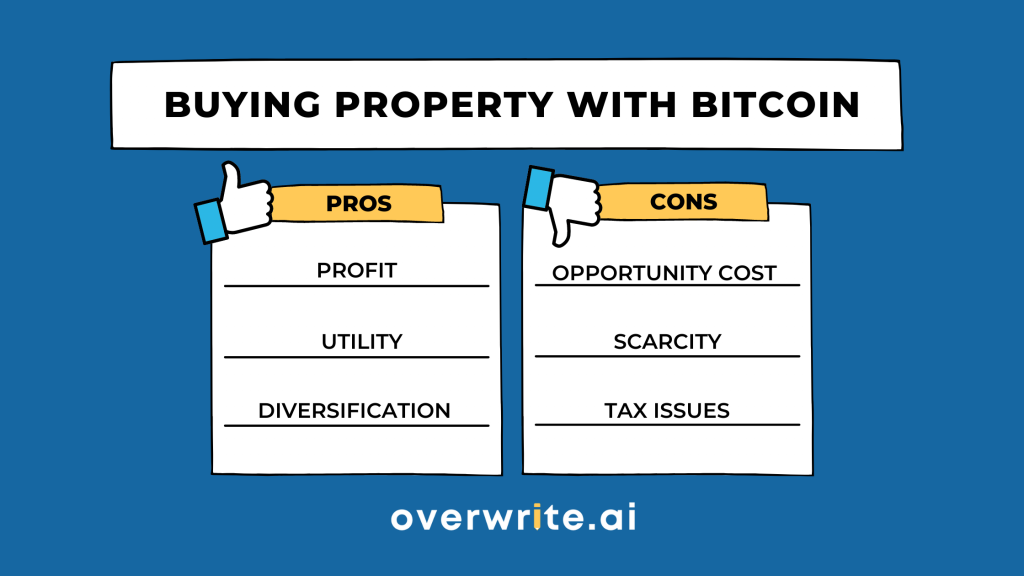

So, as crypto-buying property becomes more common, let’s dive into some buyer pros and cons…

The Pros…

Profit

Trading out of cryptos and into real estate gives investors the opportunity to quit while they’re ahead. Cryptos are a notoriously volatile asset class, not for the feint-hearted. Investing in real estate allows crypto-traders to lock in their profits, and inflation-hedge their wealth, safe in the knowledge that property, unlike Cryptos, will never fully depreciate in capital value.

Diversification

Smart investors know to never put their eggs in one basket, and many of those who have profited from cryptocurrency are considering real estate purchases to diversify their portfolio. Why real estate? Because it’s an asset generally considered one of the safest in the world.

Utility

Property gives crypto-traders the chance to shift their wealth into an asset that has greater practical application. They can either live (or work) in their property, or lease it out and derive income from it. Real estate delivers universal utility in a way that cryptos simply don’t.

…and The Cons

The Opportunity Cost of FOMO

When they rise, coin values rise much faster than real estate. By cashing in their crypto coins for real estate, buyers could miss out on future coin value appreciation.

Scarcity

Granted…crypto transactions are on the rise. But the number of sellers accepting crypto is still relatively small. The coin-purchasable property options available to would-be buyers are limited, a fact they simply have to live with, for now.

Taxation

Because it is unregulated, dealing in cryptocurrency can be a tax headache. To avoid running into trouble with the law, those looking to exchange crypto for real estate should consult an experienced certified accountant who understands the ins and outs of cryptocurrency trading in the specific subject property’s jurisdiction.

Let The Music Play 🎵

It’s safe to say that the cryptos are becoming mainstream, with more and more people joining the conversation about their suitability and appeal. This potentially giant disruptor in the real estate industry is, for many, an exciting development. But let’s not forget how famously volatile they are.

We’ve all seen their values skyrocket from an Elon Musk tweet, and similarly plummet from a central banker’s statement. They are not underwritten by any fundamental asset, and for this reason they could just as easily be worth triple today’s value in a year from now, or worth nothing at all.

There is little wonder that there are many sceptics, and rightly so. In addition to regulatory challenges like China’s recent blanket ban, tax issues and price volatility, there is the notorious affiliation that cryptos have with with criminal activity, in particular money laundering.

In the end, it comes down to each individual’s knowledge and risk-appetite. For my part, I’m long enough in the tooth to know that opportunities always come around. I’m not phased by FOMO. I’m happy to wait and watch until cryptos are more mainstream, and I have more information to base my decisions on. Until then, let the music play.

Ayman Alashkar is the Founder and CEO of overwrite.ai, with 20 years’ experience working in real estate, banking and artificial intelligence. An AI Implementation Strategist accredited by the prestigious MIT in Cambridge, Massachusetts, Ayman also has a Bachelors Degree in Mathematics from the world-renowned Queen Mary College, University of London, and a Masters in Real Estate Investment and Development from the University of Reading (UK).

OVERWRITE.ai is a world first, user-friendly marketing solution that allows estate agents to instantly autowrite unique, search-optimised property marketing content, taking the boring out of the daily grind.

For informative and light-hearted news and views on the world of real estate, follow OVERWRITE.ai on Instagram and LinkedIn, and keep up-to-date with our weekly NewsBites blog.